san francisco gross receipts tax estimated payments

25m Retail Trade. Final Payments for Q4 2014 The current due date for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement is February 28.

San Francisco Passes Proposition C To Increase Gross Receipts Tax On Commercial Landlords Coblentz Law

We cannot give the last four digits of the Federal Taxpayer.

. 5 The current Payroll Expense Tax was originally set to phase out ratably between 2014 and 2018 but was postponed by the City in 2018. Specifically the San Francisco Office of the Treasurer Tax Collector is deferring quarterly estimated tax payments of the San Francisco Local Business Taxes that would otherwise be due on April 30 2020 by taxpayers or combined groups with combined San Francisco gross receipts in calendar year 2019 of 10 million or less. The quarterly estimated payment shown in our system is based on your 2021 Annual Business Tax Returns filing.

Mail your business tax and registration fee payments to. HRGT imposed additional business taxes to create a dedicated fund to support services for homeless people and prevent homelessness including one tax of 0175 to 069 on gross receipts over 50 million that a business receives in San Francisco and another tax of 15 on certain administrative offices payroll expense in San Francisco. San francisco gross receipts tax estimated payments Friday February 18 2022 Edit.

Estimated tax payments due dates include April 30th August 2nd and November 1st. Quarterly estimates must equal 25 percent of prior. There are two components to the tax and estimated payment a payroll tax expense and a gross receipts tax.

The Citys support efforts include the deferral of business taxes and licensing fees as well as the launch of an economic relief fund. The Controllers Officer also certified that the 2018 Payroll Expense Tax rate is 0380 percent which is reduced from 0711 percent in 2017. City and County of San Francisco Treasury and Tax Collector website2018 was to be the last year of the payroll expense tax when starting in 2019 businesses were to pay only the gross receipts tax.

The Business Tax and Fee Payment Portal provides a summary of unpaid tax license and fee obligations. Residential Landlords with 2000000 or less adjusted for inflation in San Francisco gross receipts are exempt from estimated quarterly business tax payments and will not receive an estimated business tax payment notice. It is estimated that this will result in 285 million more a year in revenue to the city.

The City began making the transition to a Gross Receipts Tax from a Payroll Tax based on wages paid to employees in 2014. Beginning in 2023 estimated business tax payments are due April 30th July 31st and October 31st. Ordinance 26-17 requires businesses to make quarterly estimated payments for both the Payroll Expense Tax and the Gross Receipts Tax starting in 2017.

If this persists please contact our office by clicking here to submit a service request or by calling 311 from inside San Francisco or 415 701-2311 outside San Francisco. San Francisco Tax Collector PO. San Francisco Gross Receipts Tax Anatomy Of San Francisco Now Fewer People Jobs Tourists Businesses But More Spending By The Hangers On But That Was Inflation Wolf Street.

Quarterly estimated tax payments of the Gross. Business Tax Overhaul. 6 The passage of Proposition F fully repeals the Citys Payroll Expense Tax.

The San Francisco Office of the Controller City and County of San Francisco announced that for tax year 2018 the Payroll Expense Tax Rate is 038 down from 0711 for 2017. The last four 4 digits of your Tax Identification Number. Important filing deadlines include the San Francisco Gross Receipts filing deadline of February 28 and the April 1st business property tax filing.

You may pay online through this portal or you may print a stub and mail it with your payment. On March 11 2020 the City of San Francisco announced measures to support small businesses in light of the COVID-19 outbreak. Please note the following.

In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date. Every business with San Francisco gross receipts of more than 1090000 or payroll expense of more than 300000 is required to make three quarterly estimated tax payments and file an annual tax. Businesses operating in San Francisco pay business taxes primarily based on gross receipts.

Deferral of Quarterly Business Taxes Due April 30 2020. Welcome to the San Francisco Office of the Treasurer Tax Collectors Business Tax and Fee Payment Portal. If you operate a business in San Francisco the deadline for filing and paying the second installment of your 2014 estimated Payroll and Gross Receipts tax is due on July 31 2014.

A San Francisco Gross Receipts Tax on Businesses Proposition E ballot question was on the November 6 2012 ballot for voters in San Francisco where it was approved. Estimated business tax payments are due April 30th July 31st and. Use your San Francisco Business Activity and the SF Gross Receipts Tax Computation Worksheet to determine your San Francisco Gross Receipts Tax obligation.

You can file online with the City. Your eight 8 digit online PIN. The applicable gross receipts tax rate depends on the business activity associated with the gross receipts earned.

You may pay the lesser of the amount displayed or an amount equal to 25 of your Business Taxes due for 2022 which may be 0. San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the City. Over the next few years the City will phase in the Gross Receipts Tax and reduce the Payroll Expense Tax.

Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section 62-12 qualified by Code sections 9523 f and g and are not otherwise exempt under Code sections 954 2105 and 2805 unless their combined taxable gross receipts in the City. On June 5 2018 San Francisco voters passed Proposition C which imposes a new gross receipts tax of 1 percent on revenues a business receives from leasing warehouse space in San Francisco and 3. Measure E will phase out the citys current payroll tax over a period of five years and replace it with a gross receipts tax.

Due Dates For San Francisco Gross Receipts Tax

Payroll Specialist Salary Comparably

Ces State And Area Benchmark Article U S Bureau Of Labor Statistics

Hr Operations Specialist Salary Comparably

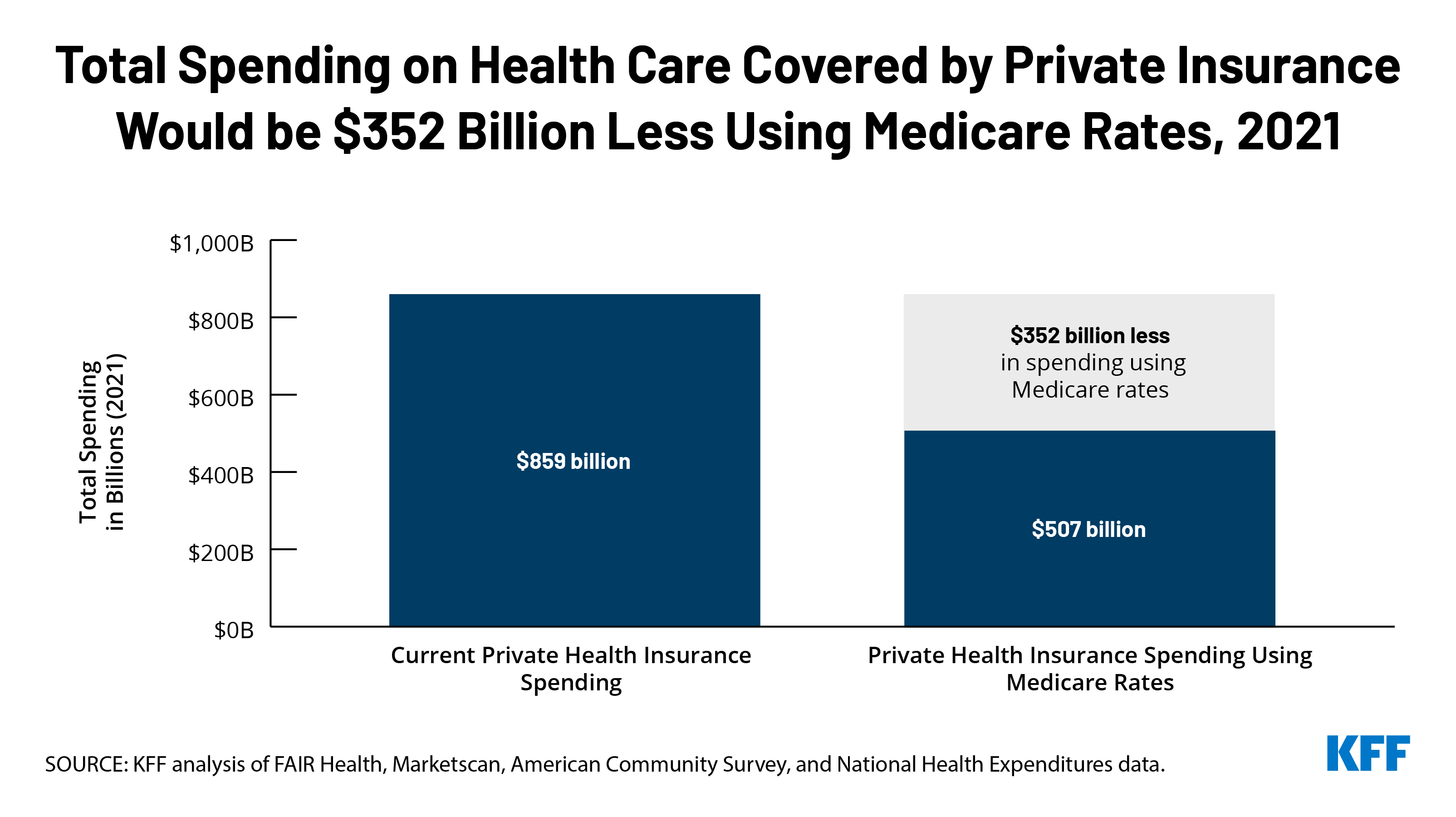

Limiting Private Insurance Reimbursement To Medicare Rates Would Reduce Health Spending By About 350 Billion In 2021 Issue Brief 9656 Kff

Philadelphia Amend Regulations Relating To Estimated Tax Payment Procedure Chamberlain Hrdlicka Attorneys At Law Mid Market Multi Service Law Firm With Nationally Leading Tax Lawyers

What Is The Take Home Salary For 100 000 In California Quora

Overpaid Executive Tax Oe Treasurer Tax Collector

State Payroll Taxes Guide For 2020 Article

Changes To Accounting For Employee Share Based Payment The Cpa Journal

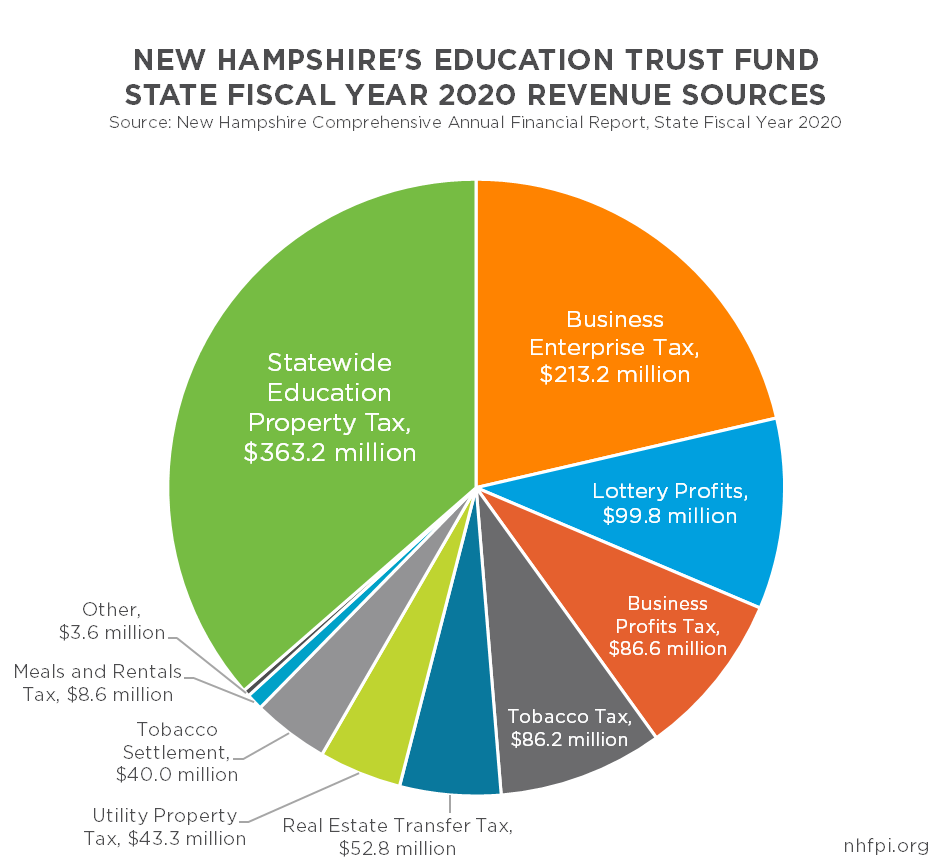

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute